In 2020, the bottled water category will accelerate growth

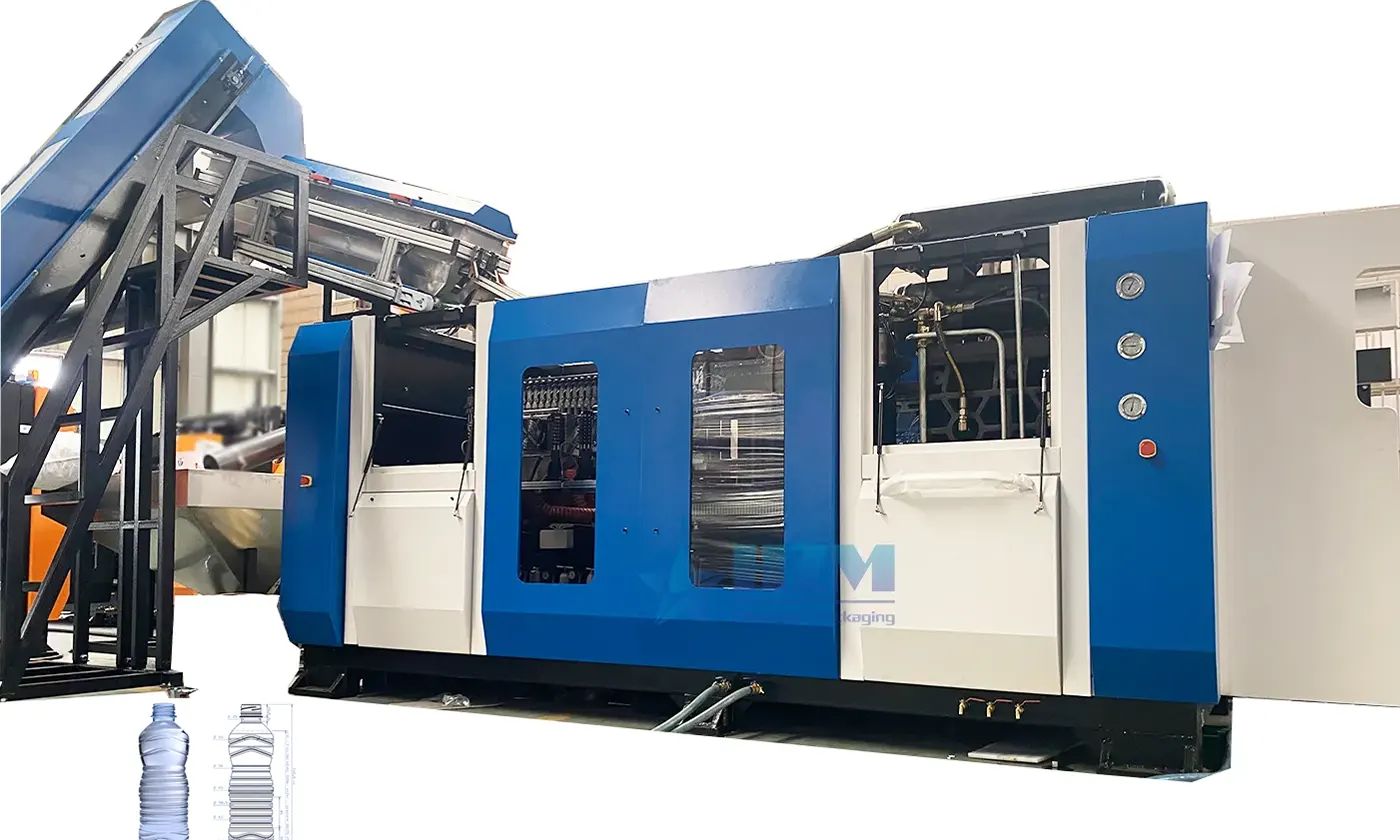

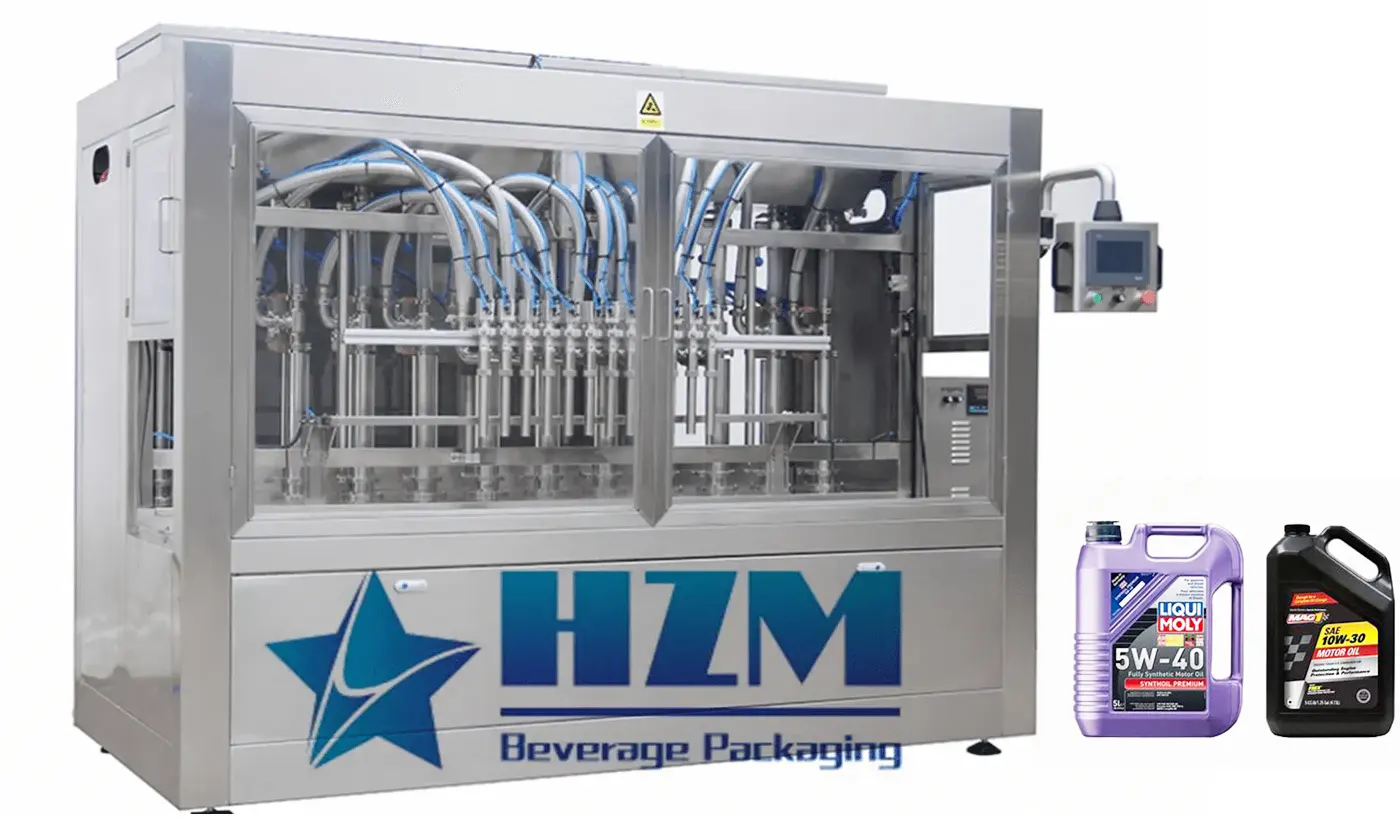

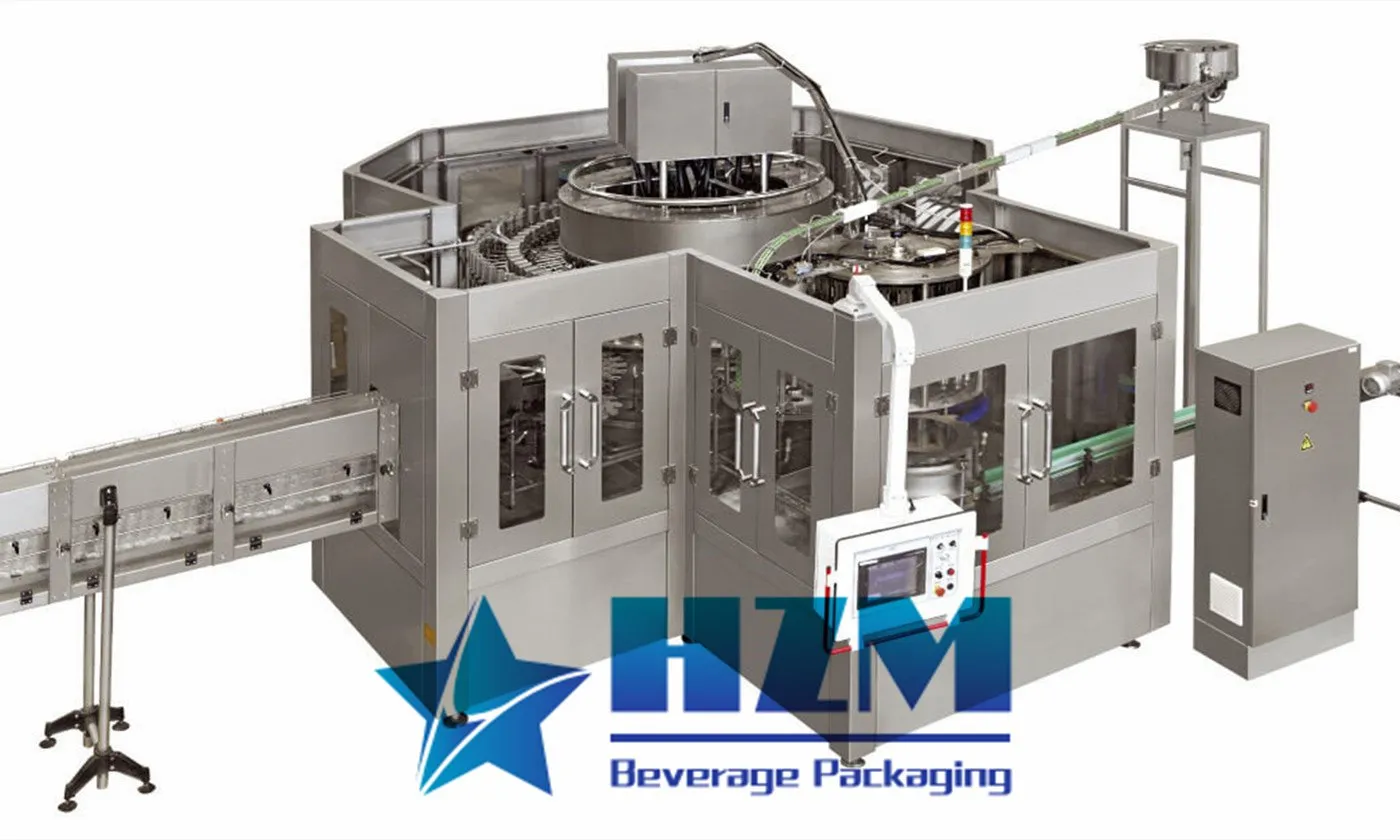

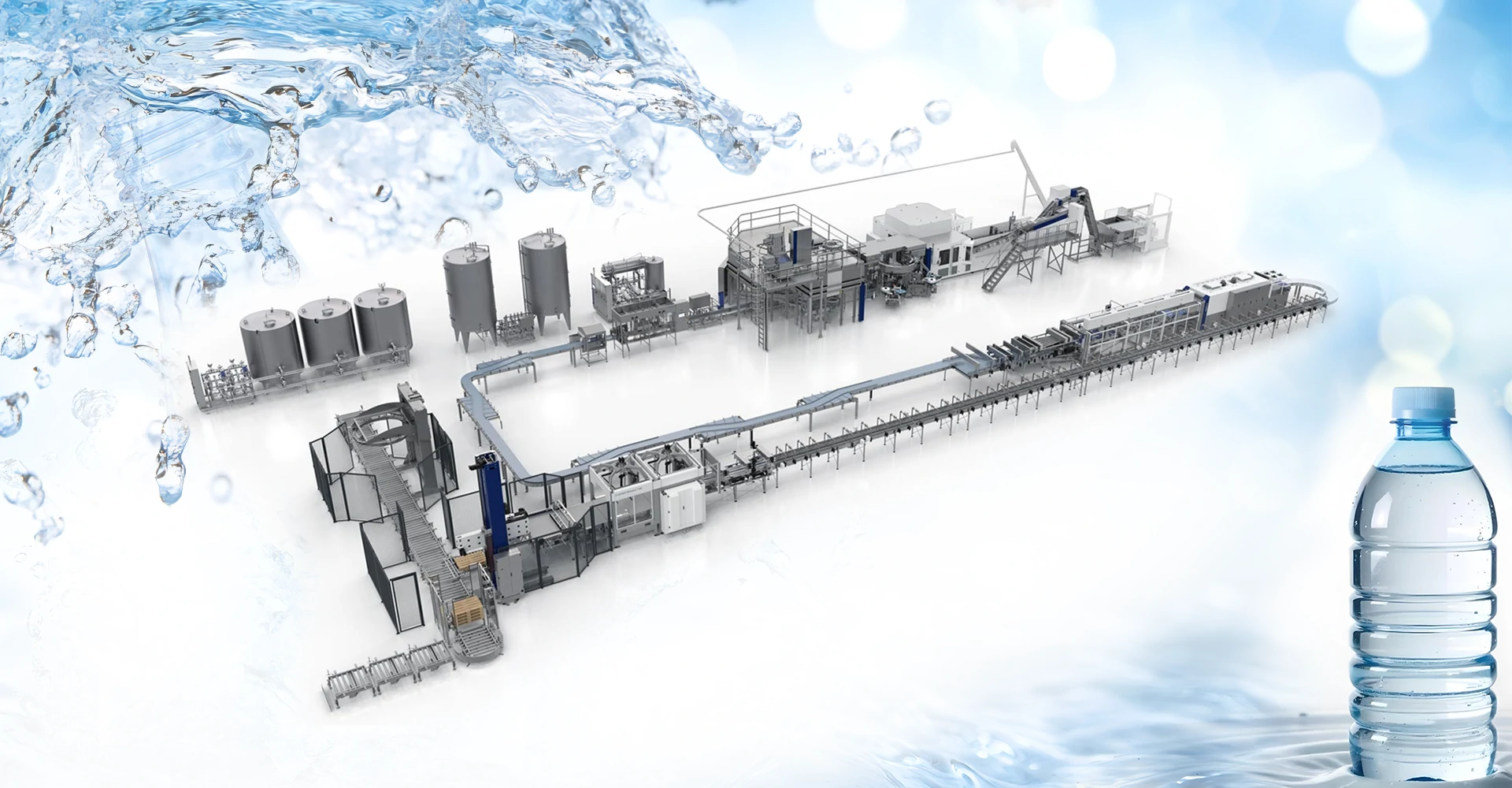

When it comes to the beverage filling machinery market, few other categories do better than bottled water filling machines.

The New York Beverage Marketing Company (BMC) research managing director said that the COVID-19 pandemic and the resulting hoarding of bottled water have also had a positive impact on product categories and growth rates.

He explained: “Bottled water continues to grow steadily and actually experienced accelerated growth in the first half of 2020. Its positioning as the ultimate health drink has been resonating among consumers. In addition, in recent years, the increasing popularity of sparkling water has also promoted The development of this category."

According to statistics, as of August 9, the total sales of bottled water was $18.5 billion, an increase of 5.9% in multiple points of sale and convenience stores in the United States. During the same period, sales of PET bottled water reached 13.1 billion US dollars, an increase of 3.2%. On a smaller scale, the sales of soda/sparkling water increased by 16.3% over the same period last year, with sales of 3.6 billion US dollars, while the sales of bottled mineral water was 1.7 billion US dollars, an increase of 6.8%.

Functionality continues to be the main trend in the water market.

Fortified water

As beverage filling machine manufacturers try new ways to improve the water's hydrating capacity and add additional health benefits, the bottled water category continues to shift towards its high end.

In the SPINS "Functional and Enhanced Drinks" report of Chicago's health-focused data technology company, many drinking water on the market today provide additional enjoyment benefits, such as carbonation, flavor persity, and healthful functional ingredients.

Sparkling water

BMC’s August 2019 report entitled "Bottled Water in the US in 2023" also mentioned its commitment to domestic sparkling water. Domestic soda water is growing at a double-digit rate. Imported soda water has outperformed the overall market, but the market share of these two types of soda water is still relatively small.

The report predicts that the retail sales of sparkling water in the United States will grow from US$1.9 billion in 2018 to US$4.9 billion in 2023, and that imported sparkling water will grow from US$3.4 billion to US$5.4 billion.

San Francisco-based hint Inc. has launched 17 flavors of zero-calorie sugar-free flavored water, and developed 7 flavors of hint sparkling mineral water, a caffeinated water production line.

There are reports that bottled water is the most popular choice. Other areas, including home and office distribution water, soda water and imported water, also achieved growth in 2019.

Sustainability

Experts pointed out that sustainability and concerns about plastic bottle pollution are driving some changes in the bottled water industry.

Although many water brands, especially fortified water, use aluminum packaging to protect the environment, the person in charge of Mintel said that he is interested in tracking the performance of ZenWTR bottles made of marine plastic.

He cited Mintel's global new product database, and he emphasized that as of August, 46% of US aquatic products were canned.

The future of the water category is still bright, especially the strong consumer demand for enhanced water and sparkling water, coupled with healthy positioning and a lot of innovation.

Both distilled water and sparkling water are growing, but sparkling water has grown faster in recent years. We expect bottled water and fortified water to continue to grow. In particular, we believe that sparkling water will continue to grow strongly, and we believe that innovation will continue to promote the growth of enhanced water.

Innovations to strengthen the water segment will expand opportunities in the beverage market. Its level of innovation has improved in the past 5 years, which helps to improve this category. Water is a great platform for innovation.

TAG:

-

![Core Selling Points of Glass Bottle CSD Filling & Capping Line]()

Core Selling Points of Glass Bottle CSD Filling & Capping Line

-

![Customizable beverage filling system]()

Customizable beverage filling system

-

![Differences Between Hot Filling and Cold Filling in Beverage Filling Machines]()

Differences Between Hot Filling and Cold Filling in Beverage Filling Machines

-

![Selecting a Dedicated RO Reverse Osmosis Water Treatment System for a Purified Water Beverage Production Line]()

Selecting a Dedicated RO Reverse Osmosis Water Treatment System for a Purified Water Beverage Production Line

-

![How Fast Is the Labeling Speed of Tea Beverage Packaging Machines?]()

How Fast Is the Labeling Speed of Tea Beverage Packaging Machines?